estate tax exemption 2022 proposal

These caps were lowered and expanded by the American Rescue Plan for 2022. The 2021 child tax credit of 3600 per child under age 6 and 3000 per child ages 6 through 17 is fully.

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

The second statewide proposition would raise the homestead exemption for school property taxes from 25000 to 40000.

. Once we accept your Homestead application you never have to reapply unless your deed changes. The changes to certain individual tax credits generally will expire at the end of 2021. A homestead exemption reduces the taxable value of your home.

If a property owner has not received their tax bill they should contact the Tax Office at 673-6041 Ext. Imposing a minimum tax on. 2022 FOR THE 2021 TAX LIEN PROCESS.

Upon paying the capital gains tax at death the value of the 100 million asset falls to 57 million for the purposes of the estate tax. With the enactment of the Tax Cuts and Jobs Act of 2017 these exemptions were doubled through December 31 2025. Increasing the top tax rate for individuals to 396.

The Biden Administrations FY 2023 Budget and Treasury Greenbook released March 28 2022 propose changes to the rules for taxing certain individuals estates and trusts as well as broadening the circumstances under which capital gains become taxableThe proposed changes include. The exemption amount is increased annually by an inflation adjustment as is the estategift tax exemption. You can fill out the online application or print one of the.

This happened after a proposal was shelved that would have reduced the threshold from 600000 to 200000. Thus as of January 1 2020 the GST exemption amount is 1158 million per person inclusive of the inflation adjustment. Exemption amounts under the state estate taxes vary ranging from the federal estate tax exemption amount or 534 million indexed for inflation two states to 675000.

The Homestead Exemption reduces the taxable portion of your property assessment by 45000 if you own a home in Philadelphia and use it as your primary residence. After subtracting the 117 million exemption the 40 percent estate tax rate is levied on the remaining 453 million in assets to produce an estate tax bill of about 181 million. Real Estate Tax Bills were mailed on November 10 2021 and are due on Decmber 10 2021.

But Lavine added he believes its fair to allow people with disabilities and the elderly to have access to the lower tax rates. It saves most homeowners around 629 each year. The Premium Tax Credit Subsidy Caps By Percentage of Household Income for SLCSP 2022.

Open Space Advisory Committee proposal Signed. The Biden administrations proposed American Jobs Plan AJP American Families Plan AFP and fiscal year 2022 budget would increase federal spending by about 4 trillion over 10 years including 17 trillion for infrastructure partially funded with higher taxes on individuals and businesses as well as increased tax enforcement. Texas Proposition 2 explained.

Premium tax credit caps on 2022 marketplace coverage range from 0 85 of income based on the 2021 federal poverty level. 2022 1206 million 40.

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

What The 2021 Tax Proposals Mean The American Families Plan Cpa Practice Advisor

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Gift Tax Exemption Could Be Reduced By 50 Percent By 2022 Davis Miles Mcguire Gardner Pllc

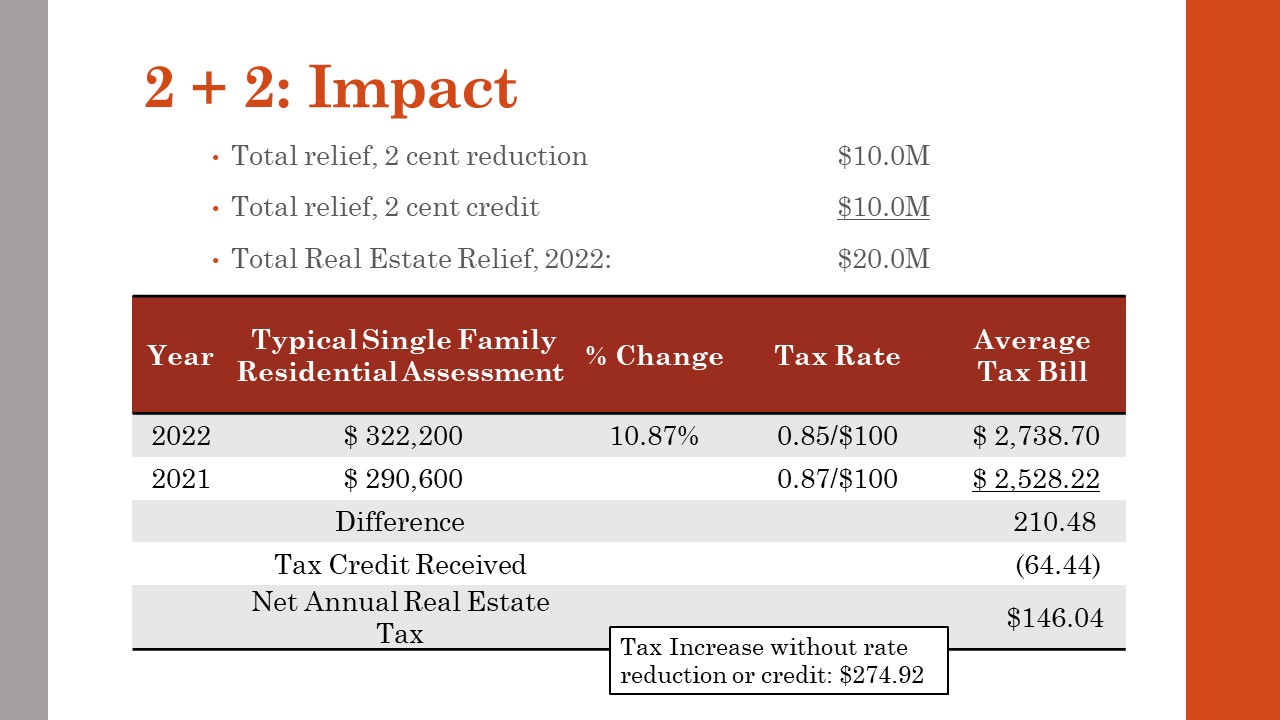

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Proposed Tax Law Changes Which May Impact You Certilman Balin

Biden Greenbook Estate Tax Proposals Should You Care

Tax Proposals Under The Build Back Better Act Version 2 0

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg